The narrative around the Indian startup story has evolved rapidly over the years. As the first generation of digital businesses mature, a new founder persona has emerged: one that boldly ventures into the areas where the predecessors were hesitant to go.

Today, larger counterparts are making smart acquisition moves on their smaller peers from a product expansion, talent acquisition, or even a new market entry point of view.

Mergers and Acquisitions (M&A) provide opportunities to established corporates for faster growth by:

Entering New Markets: Acquiring startups operating in new markets allows big companies to gain a foothold and customer base they might not have established organically.

Accessing New Customer Segments: Startups often cater to specific niches or demographics. Acquisitions allow big companies to reach these new customer segments and expand their total market share.

Acquiring Cutting-Edge Technology: Startups are often hotbeds of innovation. M&A allows big companies to access and integrate the startup’s technology, propelling them ahead of the competition.

Enhanced Innovation Capabilities: The talent and fresh perspectives from the acquired startup can invigorate the big company’s innovation engine, leading to new product development and improved processes.

Economies of Scale: Combining resources and operations with the startup can lead to economies of scale, reducing overall costs for a company.

Synergy & Efficiency Gains: Merging complementary functionalities from both companies can streamline operations and improve overall efficiency.

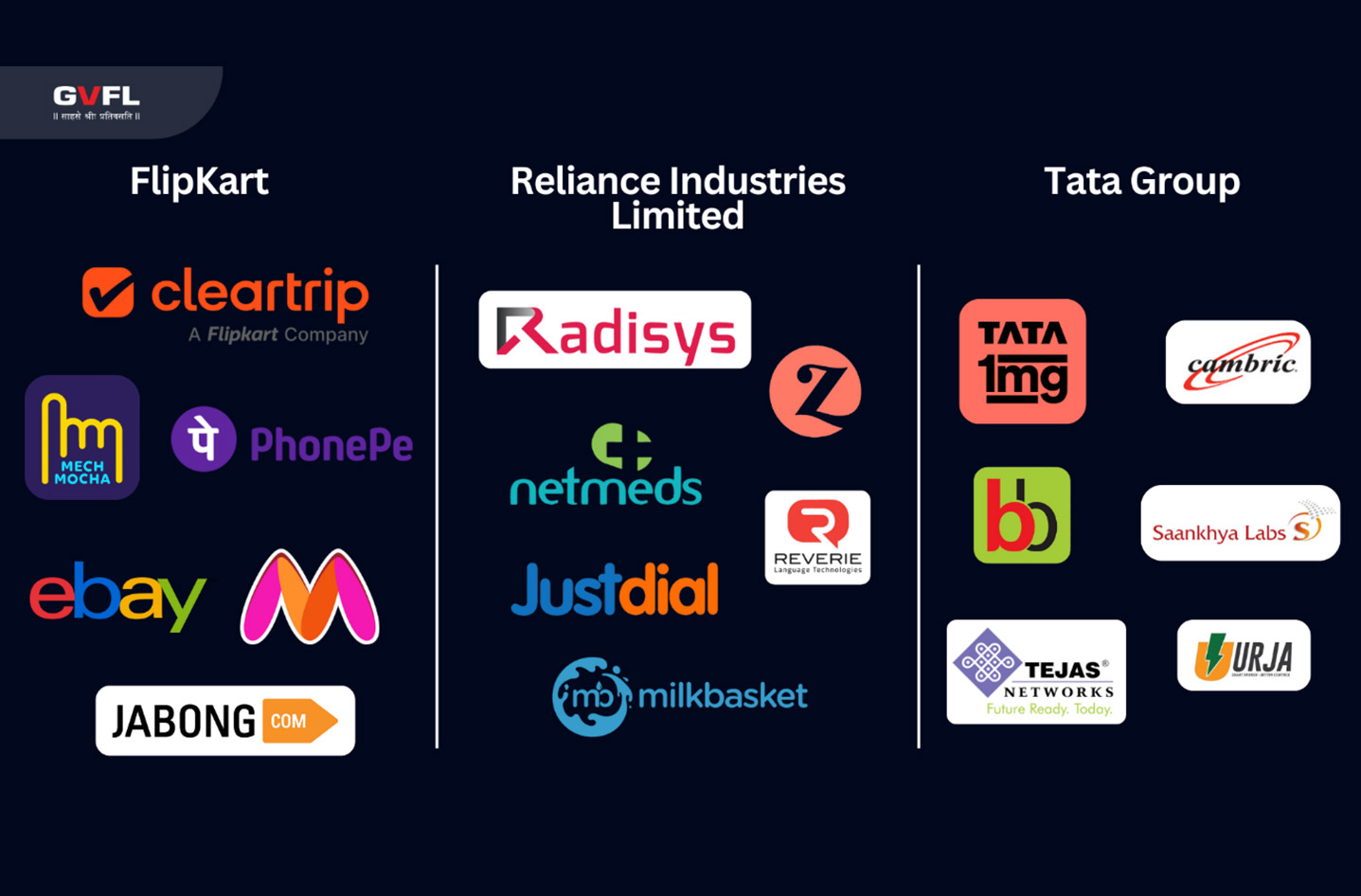

Examples of acquisitions by huge companies and their outcomes:

1. Reliance Industries

Reliance Industries made several acquisitions in the past few years to boost the product offerings of its subsidiaries – Reliance Jio Infocomm Ltd. and Reliance Retail Ltd., among others. It has invested more than $566 million in media and education, $194 million in retail, $1.2 billion in telecom and internet firms, $100 million in digital firms, and $391 million in the chemicals and energy space.

A few known startups acquired by Reliance are mentioned below:

1) Milkbasket (2021): India’s first subscription-based micro-delivery service, Milkbasket, was founded in 2015 to deliver daily groceries, milk, and other everyday essentials. Reliance Retail Ventures acquired Milkbasket by acquiring 96.49% at USD 40 Million.

Synergies from the Acquisition:

-

- Milkbasket’s already established daily micro-delivery service, strengthened Reliance’s presence in the subscription e-grocery segment, a growing market in India.

-

- Milkbasket’s existing subscriber base provided Reliance with a new pool of loyal customers for its JioMart platform.

- Leveraging Milkbasket’s existing warehouses and delivery infrastructure streamlined Reliance’s fulfillment capabilities for JioMart, potentially reducing delivery times and costs.

2) Reverie (2019): Reverie provides a voice suite in 12 Indian languages like Hindi, Telugu, Tamil, Bengali, Marathi, Gujarati, Indian English, etc., which can be integrated with both chatbots and interactive voice response (IVR) solutions. Companies can then use their solutions to engage with non-English speaking customers.

In April 2019, Reliance acquired a majority stake in Reverie for USD 27.3 Million. As a part of the acquisition, Reliance held 83.3 % equity capital in Reverie.

Synergies from the Acquisition:

-

- Reverie’s capabilities could streamline the creation and localization of content for Reliance’s various digital platforms, making them more accessible to non-English speaking users.

- Boosting expertise in Artificial Intelligence (AI) and Natural Language Processing (NLP), potentially accelerating their development of innovative language-based solutions.

3) Addverb Technologies (2021): Addverb is a leading Indian robotics and automationsolutions provider. It specializes in building robots and automation solutions for warehouses and factories, helping businesses improve efficiency and productivity. It designs and makes software and installs robotic systems making it one of the few companies in the world to work in every aspect of robotics, from hardware and software to deployment.

Reliance, through its subsidiary, acquired a controlling stake of approximately 54% in Addverb Technologies for USD 132 Million in March 2022.

Synergies from the Acquisition:

-

- Reliance could leverage Addverb’s expertise in robotics and automation to improve efficiency within its warehouses and distribution centers translating to faster order fulfillment and potentially lower operational costs.

-

- Reliance could leverage Addverb’s solutions for JioMart, Ajio Netmeds, and other subsidiaries where it deploys robotic conveyors, semi-automated systems and pick-by-voice software.

- Addverb and Reliance are working to build futuristic 5G robotic systems, battery systems and advanced robots that are affordable.

2. Flipkart

Flipkart, one of the biggest players in the e-commerce market in India, is also among the most valuable startups in the country today. This Walmart-owned company started its journey by selling books online and further expanded into selling other product varieties such as electronics, fashion, home essentials, and other lifestyle products.

Flipkart has made key acquisitions to strengthen its position in the Indian e-commerce landscape:

1) Myntra (2014): Myntra, initially sold personalised gift items but later on expanded into fashion and lifestyle brands in 2010. In 2014, the company was bought by Flipkart at a valuation of approximately USD 370 Million. The acquisition was done in to beat Flipkart’s rival Amazon to create one of the largest e-commerce markets. To date, Myntra is one of the biggest acquisitions of Flipkart.

Synergies from the Acquisition:

-

- Myntra’s established presence in the online fashion space allowed Flipkart to instantly become a major player in this high-growth market, attracting a whole new customer base interested in fashion and lifestyle products.

-

- Myntra brought its existing customer base to Flipkart, significantly expanding Flipkart’s overall customer reach.

- Myntra’s expertise in fashion-specific logistics like quicker turnaround times for trendy items potentially benefitted Flipkart’s overall supply chain management.

2) PhonePe (2016): PhonePe is a digital payment application for online transactions in India founded by Sameer Nigam. The application operates around the Unified Payments Interface (UPI), regulated by the National Payments Corporation of India. The company was acquired by Flipkart in 2016, although it functions as a separate business unit. Flipkart bought the company for USD 20 Million.

Synergies from the Acquisition:

-

- Integrating PhonePe into Flipkart’s platform provided a seamless and secure payment experience for customers, eliminating the need to switch between platforms during checkout.

-

- This significantly improved conversion rates and customer convenience, driving sales growth.

- PhonePe also allowed Flipkart to tap into the rapidly growing digital payments market in India.

3) ANS Commerce (2022): ANS Commerce is a direct-to-consumer (D2C) SaaS startup. The company offers e-commerce solutions for online brands, such as brand-store tech, performance marketing, platform support, marketplace management, and more. It provides services such as setting up digital storefronts, integration with marketplaces including Flipkart and Amazon, and warehousing and facilities maintenance services to online brands .

Flipkart acquired ANS Commerce for an undisclosed amount.

Synergies from the Acquisition:

-

- Their expertise in D2C brand solutions helped Flipkart cater to the growing demand for brands selling directly to consumers online. This allowed Flipkart to expand its brand portfolio beyond marketplace sellers and potentially attract new, high-growth D2C brands to its platform.

- Their technology solutions for setting up and managing brand storefronts could be integrated with Flipkart’s platform thus streamlining the onboarding process and providing D2C brands with a user-friendly experience.

3. Tata Group

Tata Group was founded in the year 1868 by Jamsetji Tata, and is among the oldest and largest industrial groups in India. Since its inception, the Tata Group has been one of the mainstays in the Indian corporate industry and helped the Indian economy grow exponentially over the years. Over the years, it has acquired several start-ups and has nurtured them to grow and help them excel in their respective fields.

A few notable startups acquired by the Tata Group are as follows:

1) Bigbasket (2021): BigBasket was founded in 2011 in Bangalore and has expanded its presence to 25+ cities across India since then. In the e-grocery space, BigBasket provides one of the largest assortments (50,000+ SKUs) and provides customers the convenience of home deliveries on preferred dates and time slots. It also operates a farm-to-fork supply chain with over 12,000 farmers and several collection centers across India to deliver high-quality fresh fruits and vegetables to its customers.

Tata Digital, a subsidiary of Tata Sons, acquired Bigbasket, a leading online grocery platform, for about USD 1.1 billion.

Synergies from the acquisition:

-

- Tata group entered the fast-growing online grocery market in India with Bigbasket’s acquisition and got access to an established customer base, strong brand recognition, and efficient delivery network thus allowing it to compete effectively with established players like Flipkart and Amazon.

-

- Additionally, Bigbasket’s expertise in fresh food supply chains and inventory management complemented Tata’s existing food and beverage business.

-

- The acquisition accelerated Tata’s digital transformation strategy by providing them with a well-established e-commerce platform.

- This could lead to increased online sales and growth across various product categories within Tata consumer products business.

2) Saankhya Labs (2022): Saankhya Labs is a wireless communication solutions company, it is a semiconductor firm founded in the year 2007. The company focuses on providing semiconductor products for radios, satellite communication and other wireless technologies in India and abroad. Saankhya has 73 international patents, including 41 granted and 32 filed, and builds software defined radios (SDR) powered by its own chipsets.

Tata Group firm Tejas Networks acquired a 64.4% stake in semiconductor firm Saankhya Labs for Rs 283.94 crore in an all-cash deal.

Synergies from the acquisition:

-

- This acquisition marked Tata’s foray into the semiconductor business, a critical and growing industry.

-

- Saankhya Labs’ expertise in chip design and system development allowed Tata to gain a foothold in this strategic area.

- The combined expertise of Tejas Networks and Saankhya Labs could foster innovation in next generation wireless technologies like 5G broadcast and Open RAN (O-RAN) solutions.

To summarize, large companies can use mergers and acquisitions with startups to utilize technologies without building them from scratch, enter new markets, access new customer segments, and optimize their existing processes. Acquiring startups helps larger companies stay ahead of the curve by positioning them for sustained success and building robust, competitive businesses.